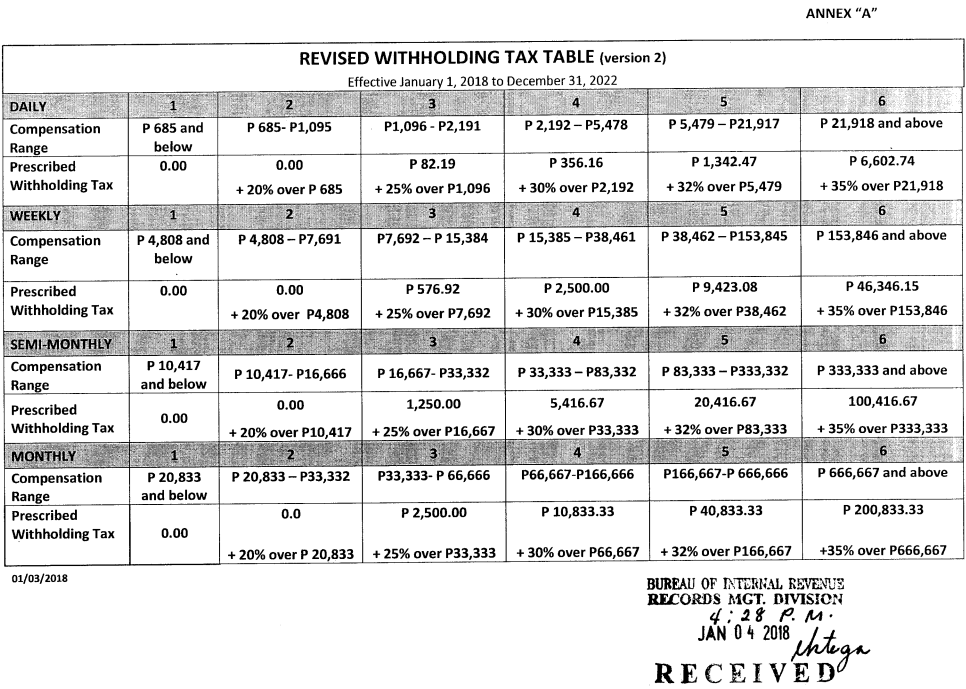

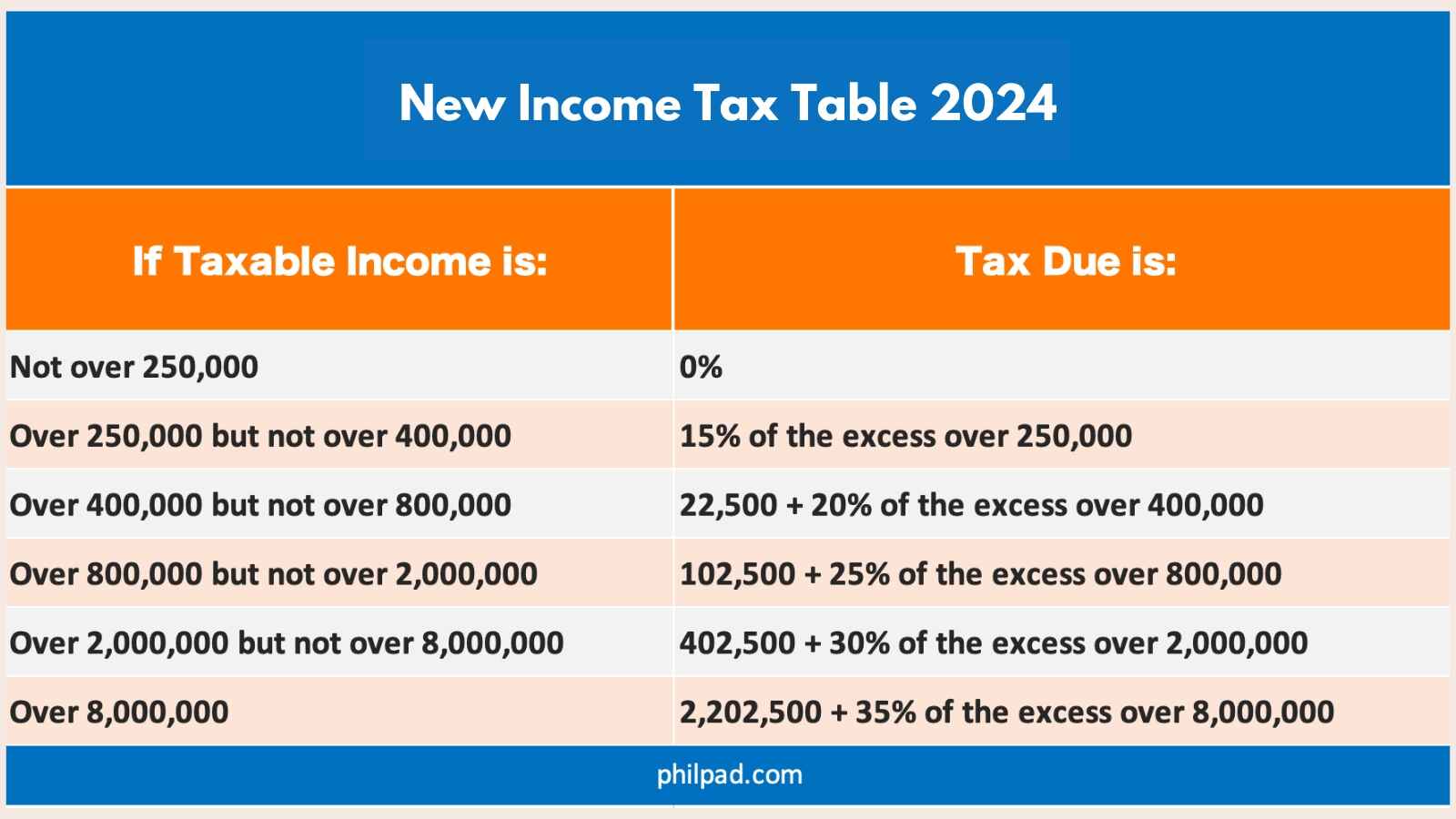

Income Tax Brackets 2025 Philippines. Your average tax rate is 5.4%. Refer to the bir income tax table:

Refer to the bir income tax table: This calculator also works as an income tax calculator for philippines, as it shows you how much income tax you might have to pay based on your salary and personal details.

The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income.

2025 Tax Bracket Single Filer Ethyl Janessa, The new tax regime also levies lower tax rates on the same gross income compared with tax liability calculated under the old tax regime. Whether you’re an individual or a freelancer, these.

Tax Brackets 2025 Single Person Cherri Cristina, Tax brackets 2025 irs single linda tamarra, get familiar with. With per capita incomes at least equal to 20 times the poverty line.

Tax Calculator Philippines 2025 Daron Emelita, Download here the new bir income tax tables under the approved train tax law of the philippines. The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income.

Philippine Corporate Tax Rate 2025 Alli Luella, If you make ₱ 202,024 a year living in philippines, you will be taxed ₱ 10,841. Up to rs 2.5 lakh:

Irs Tax Brackets 2025 Over 65 Dorris Courtnay, However, until june 30, 2025, the mcit is temporarily reduced to 1%. Www.msn.com irs tax bracket changes.

Philippine Corporate Tax Rate 2025 Alli Luella, The compensation income tax system in the philippines is a progressive tax system. In today's dynamic business landscape, tax regulatory changes wield a significant.

Tax Table 2025 Philippines Calculator Billy Cherish, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. Refer to the bir income tax table:

Tax Tables 2025 Astra Jessica, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and. That means that your net pay will be ₱ 191,183 per year, or ₱ 15,932 per month.

Tax Brackets 2025 Philippines Cody Mercie, Rs 2,50,001 to rs 5 lakh: Calculate and compare your 2025 annual salary after tax to other salaries using the online philippines salary comparison calculator, updated with the 2025 income tax rates in.

2025 Tax Brackets Mfj Gracia Gwenora, Download here the new bir income tax tables under the approved train tax law of the philippines. The compensation income tax system in the philippines is a progressive tax system.